KREDITBEE LOAN APP:

Online lending transactions between banks and NBFCs and borrowers are facilitated by KreditBee. The platform offers personal loans with interest rates that rise to 29.95% p.a. for loan amounts up to Rs. 3 Lakhs and for terms up to 15 months. The KreditBee Personal Loan has a quick disbursal time (within 15 minutes) and requires little paperwork. On top of that, KreditBee offers a pre-closure option for personal loans.

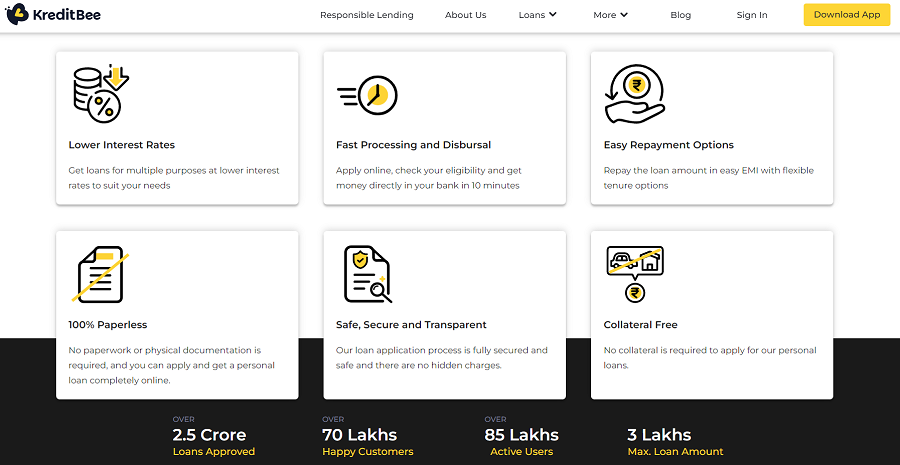

Highlights and Benefits of KreditBee Personal Loan

- Complete flexibility in utilization: A KreditBee moment individual credit permits you to involve the assets for various purposes. Clinical emergencies, travel bills, mid-month cash crunches, gifts for exceptional occasions, and other unanticipated costs can be generally covered with the assets gave.

- No insurance: An individual credit is an unstable advance, and that implies it requires no sort of safety or guarantee, like stocks, cash, or different resources.

- Quick payment with minimal measure of desk work: Depending on your capabilities, an individual credit application can be endorsed in under 2 minutes. The whole application strategy depends on effortlessness, with highlights like speedy payment in 15 mins and little documentation, and reimbursement residency of as long as two years.

Why choose KREDITBEE

- Quick Online Processing: The Personal Loan application process is completed on the web. You get moment endorsement on your credit and cash in your ledger in only 15 mins.

- Insignificant Paperwork Involved: You can get the credit with negligible documentation.

- Straightforwardness: Rest guaranteed that you will be accused of positively no secret charges.

- Hand crafted Loans: Get the best Personal Loan offers that meet your prerequisites, here. Don’t bother looking somewhere else!

- Confided in Companion: Customers across India have picked Bajaj MARKETS as their confided in monetary accomplice for Personal Loan. It’s your turn now!

Types of Personal Loans provided by KreditBee

- Flexi Personal Loan

- Personal Loan for Salaried

- Online Purchase Loan/E-Voucher Loan

- Flexi Personal Loan –The Flexi Personal Loan is designed for salaried people who need small-ticket loans to cover little needs or cover unexpected situations (insurance premiums, utility bills, etc.). After applying, the loan money is disbursed within 15 minutes.

Two months (at least 62 days) to six months

Amount of Loan: $1,000 to $10,000 (Based on the repayment track record and other factors, borrowers can increase their loan amount eligibility to Rs 1 lakh at later stages)

Interest Rate: 18.00% to 29.95% per annum

Required Minimum Salary: $10,000 per month (net)

- Personal Loan for Salaried–Within one working day after receiving a loan application, qualifying salaried borrowers receive their personal loans. Employees who want to stay with their current employers for the duration of their loan are preferred by KreditBee for loan funding.

Three to fifteen months

Amount of Loan: 10,000 to 3 lakhs rupees

Interest Rate: 15% to 29.95% per annum

A monthly salary of at least Rs. 15,000 is required (net). A paid person may borrow up to 200% of their net monthly pay.

- Online Purchase Loan/E-Voucher Loan–Salaried people can get an online purchase loan or e-voucher loan to pay for their purchases on partner sites of KreditBee. They can create an account on KreditBee and pay a deposit up front to get e-vouchers on EMI to use at various online retailers.

Tenure: The E-Voucher expires one year after it was first issued.

Loan Amount: The E-Voucher loan amount must not exceed the designated credit limit (found in the KreditBee app) or the amount chosen as the down payment for the item being purchased.

Interest Rate: 24% p.a. and up

- Qualifications for a KreditBee Personal Loan

- Acceptance for a Flexi Personal Loan

- Minimum Salary Requirement for Indian Citizens: 10,000 per Month (net)

Age range: 21 to 45

Loan for Salaried Personnel

- Indian national

Minimum monthly salary need of $15,000 (net)

Age range: 21 to 45

Work experience: 3 months or more (in the current organization)

Loan for Online Purchases/E-Vouchers

Indian citizen; above 21 years old

- Information Needed to Apply for a Personal Loan from KreditBee Flexi Personal Loan

- Personal Loan for Salaried: Voter ID Card, Aadhaar Card, Passport Address Proof

Voter ID, Aadhaar, and passport are acceptable forms of address proof for PAN cards. Salary account bank statements

Wage slips

- Loan for Online Purchases/E-Vouchers – Proof of Address Using PAN Card

- KreditBee Personal Loan Customer Care

You can connect with the client care branch of KreditBee in the accompanying ways:

You can approach 080-4429-2200 (call charges appropriate)

You can send an email on help@kreditbee.in

You can send a letter on third Floor, No.100, The Royal Stone Tech Park, Benninganahalli, K.R.Puram, Bengaluru, India – 560016

- What amount of time will it require for my own advance to get dispensed?

Assuming your KreditBee individual advance application is supported, it can get dispensed to your ledger inside 1 working day.

- My flexi individual advance application just got dismissed. Could I reapply for it?

Indeed, you can reapply for a KreditBee flexi individual credit after finishing of 90 days counted from the date of your last application.

- If people don’t have a Google or Facebook account. It is as yet feasible for them to utilize KreditBee application?

No, a Facebook or a Google account is important to join on the KreditBee application.

- Is it conceivable to get the individual credit sum moved to another person’s ledger?

No, the individual credit sum can get moved to your investment funds or current record.

- Where might I at any point realize about my month to month reimbursement plan?

You can login to the application to realize about your reimbursement plan.

- How might I reimburse my own advance?

You can reimburse your own advance by making a web-based installment through charge card, Internet banking, PayTM wallet or bank move.